Dollar Strength How to Read the Signal and Why It Matters

Dollar Strength is a central theme for investors policy makers and businesses worldwide. Understanding why the value of the US dollar moves up or down helps readers make smarter decisions about savings investments and international commerce. This guide explores the main drivers of dollar movements the metrics to watch and practical steps to respond to shifts in currency strength.

What Do We Mean by Dollar Strength

When we refer to Dollar Strength we mean the relative value of the US dollar compared to a basket of other currencies or to a specific currency such as the euro or the yen. A stronger dollar buys more foreign currency and lowers the cost of imports for US consumers. A weaker dollar buys less foreign currency and makes exports more competitive for US firms. Traders measure Dollar Strength with indexes and exchange rates and monitor changes in liquidity interest rate expectations and risk sentiment.

Key Drivers of Dollar Strength

Monetary policy ranks among the top drivers of Dollar Strength. When the central bank raises interest rates the higher yields attract capital which can raise demand for the currency. Conversely when policy becomes easier lower yields can reduce demand. Another major factor is relative economic performance. Strong GDP growth rising employment and steady inflation often support currency strength by attracting global investment flows.

Geopolitical events and global risk appetite also play a big role. In times of market stress investors often seek safe assets and the US dollar frequently benefits from this flight to safety. Trade balances foreign direct investment flows and differential fiscal positions between countries shape long term currency trends.

Indicators to Watch for Dollar Strength

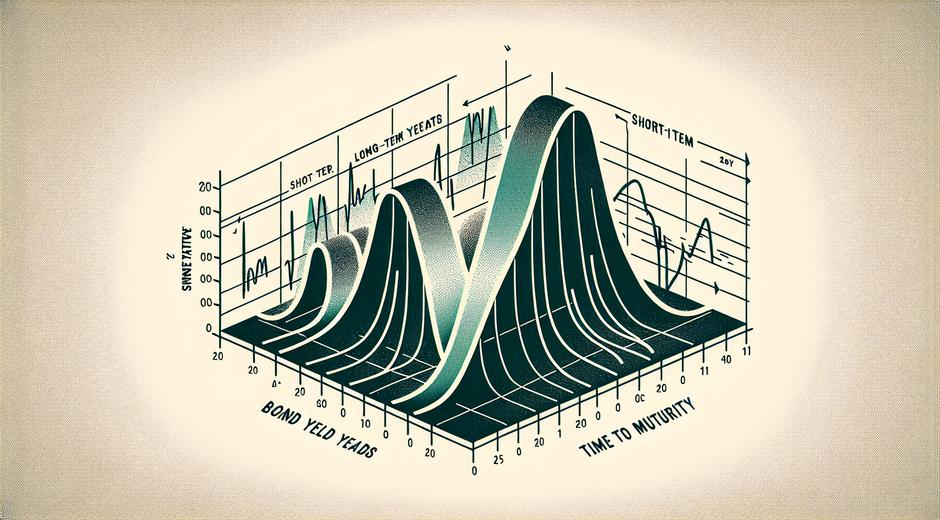

There are several indicators that investors and analysts use to anticipate changes in Dollar Strength. Key metrics include inflation data employment reports and central bank minutes. Bond yields in the United States versus those in other major economies provide a view into how attractive US assets are for global capital. Currency indexes such as the trade weighted dollar index give a consolidated measure of strength across a basket of currencies.

Market implied rates from futures and options markets reflect expectations for future interest rate moves and can be powerful leading indicators for Dollar Strength. Another useful signal is capital flow data which shows cross border investment movements that support or weaken the currency.

How Dollar Strength Impacts Different Market Sectors

When the dollar strengthens exporters may face pressure as their goods become more expensive for overseas buyers. Companies that earn a large share of revenue abroad often report lower translated earnings which can affect stock prices in certain sectors. On the other hand importers and domestic consumers may benefit from lower prices on imported goods which can ease inflationary pressures.

For commodity markets the relationship varies. Many global commodities trade in US dollars so a stronger dollar can put downward pressure on commodity prices as more goods become expensive in local currency terms. This effect can ripple through commodity driven economies and influence global growth expectations.

Strategies to Manage Exposure to Dollar Strength

Investors can take several approaches to manage currency risk and to position for shifts in Dollar Strength. Diversification across currencies and regions helps reduce concentrated exposure. Hedging via currency forwards and options allows businesses and investors to lock in exchange rates for an agreed period. For long term investors choosing assets priced in multiple currencies or selecting funds that hedge currency exposure can help stabilize returns across cycles.

For those who want to learn more about financial education and skills that help interpret currency movements consider this resource for broader learning and skill building StudySkillUP.com. The right knowledge helps you convert insights about Dollar Strength into practical investment choices.

Implications for Emerging Markets and Global Trade

Rising Dollar Strength can create pressure for economies that hold large amounts of dollar denominated debt. As the currency strengthens the local cost of servicing that debt rises which can strain public and corporate finances. Trade dynamics shift as imports priced in dollars become costlier potentially slowing consumption in vulnerable economies.

Central banks in emerging markets may react to a stronger dollar by raising policy rates to defend their currencies which can slow local growth. These dynamics make careful monitoring of global capital flows and external leverage essential for policymakers and investors focused on emerging markets.

Dollar Strength and Inflation

There is a close link between Dollar Strength and measured inflation. A stronger dollar tends to lower import prices which can reduce headline inflation. This effect gives central banks more room to support growth without stoking inflation. Conversely a weaker dollar can raise import costs and add to inflationary pressures requiring tighter policy. Understanding this relationship is key to anticipating central bank responses and interest rate changes which feedback into Dollar Strength.

How Traders and Investors Use Dollar Strength as a Signal

Active traders use momentum and mean reversion strategies to trade currency moves directly through forex markets or indirectly through equities commodities and bonds. Position sizing risk management and correlation analysis are crucial when using Dollar Strength as a trading theme. Long term investors view Dollar Strength as part of a broader macro backdrop informing asset allocation decisions across regions and sectors.

Practical Steps for Businesses

Businesses exposed to currency fluctuations should consider comprehensive currency management policies. These policies include regular forecasting scenario planning and the use of hedging instruments to manage short term volatility. Pricing strategies that account for currency moves can protect margins and support stable cash flow. When planning capital expenditure or cross border investment businesses should evaluate the possible outcomes under different Dollar Strength scenarios and stress test their balance sheets.

For timely financial insights and market commentary users may visit our main page at financeworldhub.com to explore articles guides and tools designed to help readers understand trends such as Dollar Strength. Our content aims to bridge theory and practice and to deliver actionable ideas.

Outlook and Final Thoughts

Forecasting the path of Dollar Strength is complex yet critical for a wide range of market participants. The interplay of monetary policy relative economic performance global risk sentiment and structural factors such as trade balances determines the currency trajectory. Staying informed about data releases central bank communications and global events provides an edge in interpreting signals from foreign exchange markets.

Whether you are an investor managing portfolio risk a corporate treasurer overseeing cash flows or a policymaker assessing economic stability understanding Dollar Strength is indispensable. Use a blend of data driven analysis scenario planning and prudent hedging to navigate currency cycles and to convert insight into better financial outcomes.