Treasury Auctions Explained A Complete Guide for Investors

What are Treasury Auctions

Treasury Auctions are the primary process by which a government sells its debt securities to the public and to financial institutions. In the United States the Treasury uses auctions to issue bills notes and bonds that finance government operations and refinance maturing debt. These events set the supply and the initial market pricing for government securities which makes them central to interest rate formation and to the functioning of global fixed income markets.

Why Treasury Auctions Matter

Treasury Auctions are closely watched by portfolio managers central banks bond traders and individual investors. The auction result tells market participants what yield the government will pay on newly issued securities and whether demand was strong or weak. Strong demand can push yields lower which can influence borrowing costs across the economy. Weak demand can push yields higher which can raise borrowing costs for corporations and households. For anyone tracking macro risk or building a portfolio of fixed income assets understanding auction dynamics is essential.

How Treasury Auctions Work

The auction process begins with an announcement that specifies the amount to be sold the auction date the settlement date and the terms of the security. There are two primary ways to bid in an auction. Investors can submit a noncompetitive bid where they agree to accept the yield determined by the auction. Noncompetitive bids guarantee that the bidder receives the security but with no control over the yield. The other option is a competitive bid where an investor specifies the yield or price they are willing to accept. Competitive bidders may not receive the full amount they request if the yield they specify is too low relative to market demand.

After bids are submitted the Treasury ranks competitive bids by yield and accepts them starting with the lowest yield until the offering amount is allocated. The highest accepted yield becomes the auction stop yield and it determines the price paid by noncompetitive bidders and most successful competitive bidders. Settlement occurs on the stated date when funds move and securities are delivered to accounts held by institutions or individuals.

Types of Securities Offered at Auctions

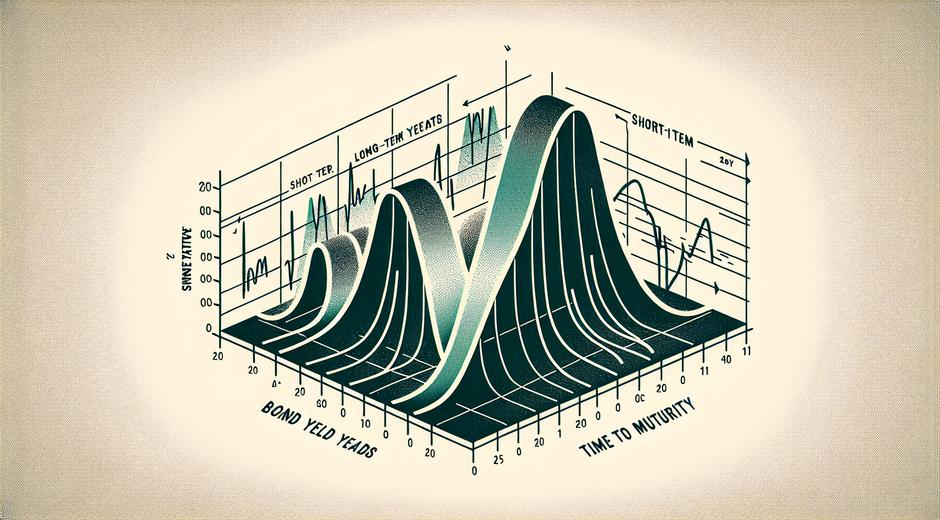

The Treasury offers a range of maturities to meet diverse investor needs. Treasury bills are short term instruments with maturity terms of a few days up to one year. Treasury notes cover maturities from two years to ten years. Treasury bonds cover longer maturities such as thirty year issues. There are also Treasury inflation protected securities known as TIPS which provide protection against inflation by adjusting principal with changes in the consumer price index. Each type of security has its own auction schedule and market participants may prefer a specific maturity depending on their portfolio goals and interest rate outlook.

Who Participates in Treasury Auctions

Participation spans a wide range of market players. Primary dealers are banks and financial firms that have an obligation to bid in Treasury Auctions and to make markets in government securities. Institutional investors such as pension funds mutual funds and insurance companies also play a major role. Individual investors can participate directly through noncompetitive bids or indirectly through funds and brokers. Foreign central banks and sovereign wealth funds are often major buyers as well which makes Treasury Auctions a point of global interest.

Interpreting Auction Results

Auction metrics provide insight into market sentiment. One key metric is the bid to cover ratio which measures demand by dividing total bids by the amount offered. A higher ratio indicates strong demand. Yields and the level of awards to different classes of bidders reveal how the market is valuing new issuance. When auctions show strong demand and yields drop this can signal confidence in government credit and lower expected rates. Conversely weak demand and rising yields can indicate concern about inflation or fiscal outlook.

How Auction Outcomes Affect Markets

Results from Treasury Auctions ripple through global markets. Treasury yields serve as benchmarks for pricing many other financial products including corporate bonds mortgages and derivatives. When auction yields move materially they can cause banks and lenders to adjust rates on loans and new debt issuance. In addition asset managers may reposition portfolios in response to auction outcomes which can lead to price moves in equities and commodities. Central banks monitor auction developments as part of their broader analysis of monetary conditions.

How to Participate in a Treasury Auction

Investors who want direct access to Treasury Auctions can submit noncompetitive bids through their broker or through a Treasury Direct account which is designed for retail investors. Noncompetitive bids are simple and allow individuals to secure an allocation without specifying a yield. Competitive bidding requires more expertise and is typically used by institutions. Before participating investors should understand settlement procedures tax implications and custody arrangements. For those building savings and seeking safety Treasuries provide credit quality backed by the full faith and credit of the issuer.

For ongoing education on fixed income strategies and auction calendars you can explore resources at financeworldhub.com which provides articles and tools for investors of all experience levels.

Common Strategies Around Auctions

Investors use a variety of approaches when engaging with Treasury Auctions. Some adopt a buy and hold method favoring predictable income and capital preservation. Others use rollover strategies in which maturing securities are repeatedly reinvested into new auctions to manage duration and liquidity. Traders may use auction days to position for short term moves by exploiting temporary supply shocks or shifts in demand. Portfolio managers often balance Treasuries against risk assets as part of broader asset allocation decisions.

Risks and Considerations

Although Treasury securities are widely viewed as low credit risk they are not free of other risks. Interest rate risk can lead to capital losses if yields rise after purchase. Inflation risk may erode real returns especially for nominal securities. Liquidity can vary across maturities and in stressed market conditions even high quality securities can face trading gaps. Political and fiscal developments influence issuance size and investor perception. Careful planning and risk management are necessary when allocating to Treasuries in a diversified portfolio.

Practical Tips for Investors

- Check the auction calendar to know when different maturities will be offered

- Decide whether a noncompetitive bid meets your needs for certainty and simplicity

- Monitor bid to cover ratios and yield movements to assess demand and potential value

- Consider laddering maturities to manage reinvestment risk and to maintain liquidity

- Stay informed about fiscal and macroeconomic developments that can influence auction outcomes

Further Reading and Tools

For readers interested in deepening their knowledge about auctions and fixed income markets there are specialized publications research portals and data services that track auction statistics market flows and yield curves. An example of a resource that explores complementary topics related to taste and lifestyle may be useful for broader learning outside finance and can be found at TasteFlavorBook.com.

Conclusion

Treasury Auctions are a foundational part of public finance and a central mechanism for setting yields that influence the broader economy. Investors who understand how auctions function how to interpret auction metrics and how auction results impact markets can make more informed decisions about income assets and risk allocation. Whether you are a long term investor or an active trader mastery of auction basics will enhance your ability to navigate fixed income markets and to align your strategy with changing market conditions.