Central bank policy and its role in modern economies

Central bank policy sits at the heart of macroeconomic management. When readers search for insights about inflation control, growth support and financial stability they want clear answers on how central bank policy shapes the economy and what decisions matter most for markets and households. This article explains the main tools central banks use the goals they aim for and how those choices ripple through lending markets asset prices and real activity.

What is central bank policy

Central bank policy refers to the set of actions taken by a national monetary authority to influence money conditions credit costs and financial system functioning. The main objectives are price stability employment support and the preservation of a safe and efficient payment system. Central banks have become more transparent over time explaining policy goals and strategies so the public and market participants can form better expectations.

Primary goals and trade offs

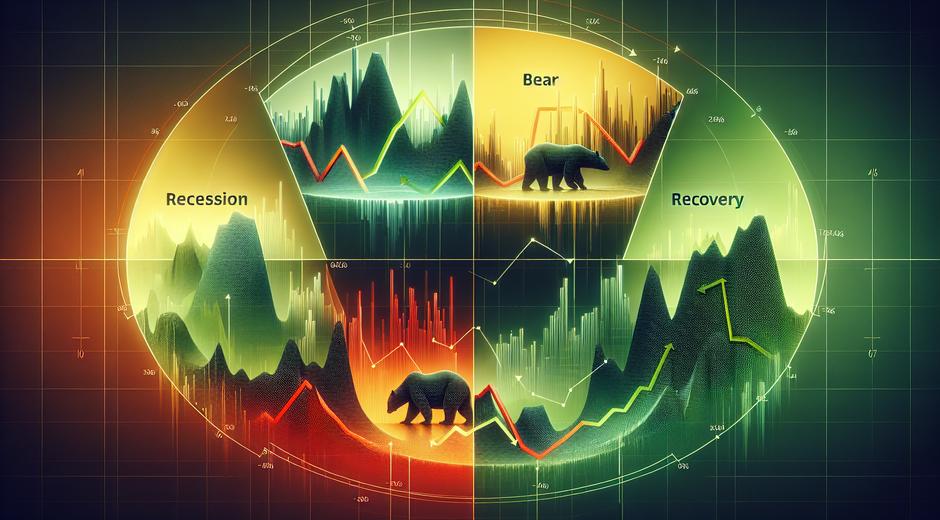

The twin axis of central bank policy typically involves managing inflation and supporting economic growth. At times these aims align. In other circumstances a central bank faces a trade off. For example when inflation rises rapidly the policymaker may need to tighten conditions to restore price stability even if that slows growth. Conversely when output falls short of potential the bank may ease conditions to lower borrowing costs and support recovery. Modern policy frameworks also consider financial stability and inequality concerns but the focus on inflation control remains central for many advanced economies.

Core tools used by central banks

Central banks rely on several main instruments. One is the policy rate which is the benchmark interest rate that guides short term private sector borrowing costs. By raising or lowering this rate central banks influence the cost of credit and the return on savings which in turn affects consumption and investment decisions.

Another key tool is open market operations where the central bank buys or sells government securities to adjust bank reserves and short term interest rates. In times of crisis banks have used balance sheet operations to provide liquidity and support market functioning. Quantitative easing involves large scale asset purchases to lower long term yields and ease financial conditions when the policy rate is at or near zero.

Central banks also use reserve requirements payment of interest on reserves and standing lending or deposit facilities that act as a backstop for the banking system. Macroprudential measures that limit risk taking in credit markets are increasingly coordinated with monetary policy to preserve financial stability.

How central bank policy affects households and firms

Changes in central bank policy change borrowing costs for households and firms. When the central authority lowers the policy rate mortgage rates and business loan rates tend to fall which supports spending on homes durable goods and productive investment. Lower rates also often lift asset valuations which increases household net worth and can strengthen consumption.

Higher policy rates make credit more expensive and usually slow consumption and investment. That impact reduces economic momentum and can help cool inflationary pressures. The transmission from policy actions to real economy outcomes is not instantaneous. It occurs over months and sometimes years as contracts reset expectations and balance sheets adjust.

Expectations and communication

One of the most powerful levers central banks have is forward guidance. By clearly communicating the likely path of policy and the data that will guide decisions a central bank can shape expectations about future rates and yields. Effective communication reduces uncertainty and can make policy more efficient by aligning market behavior with official objectives.

Transparency about the policy framework and decision process helps households and firms plan. When central banks explain the conditions under which they will alter policy they anchor inflation expectations which supports stable long term contracts and investment decisions.

Central bank policy in a globalized world

Monetary policy is not made in isolation. Global capital flows and exchange rate movements affect domestic conditions. When major central banks adjust policy their decisions ripple through global rates and asset prices. Smaller open economies often weigh the impact of external developments heavily in their policy deliberations because capital mobility can transmit shocks quickly across borders.

Coordination of central bank actions is not about uniform policy but about recognizing external constraints. Currency interventions and reserve management sometimes accompany monetary actions when exchange rate volatility threatens price stability.

The role of independent decision making

Independence from short term political pressure is widely seen as essential for credible central bank policy. When a central bank has the freedom to focus on long term price stability it can build a track record that anchors expectations. That credibility lowers the cost of achieving stable prices because markets trust the commitment and adjust behavior accordingly.

Nevertheless central banks are accountable to elected officials and the public. Transparent reporting testimony and independent audits are common mechanisms to preserve trust while protecting operational independence.

Policy in times of crisis

During financial stress and economic downturns central banks often deploy unconventional measures. Large scale asset purchases targeted lending facilities and emergency liquidity lines to banks and non bank financial institutions can restore market functioning. The 2008 global crisis and the recent global health shock illustrated how central bank policy can act as a stabilizing force when fiscal support and private market solutions are insufficient.

However crisis response raises questions about exit strategy and eventual normalization. A careful phased approach is necessary to avoid market disruption while ensuring inflation and financial risks remain contained once normal conditions return.

Measuring success and evolving frameworks

Success in central bank policy is often measured by whether inflation is near target and whether the financial system operates smoothly. Central banks now use a wider set of indicators including wage growth income distribution indicators and financial market signals to guide policy. Some institutions are exploring average inflation targets and flexible approaches that consider the history of past misses when setting the path for future policy.

As economies change central bank strategy evolves. Demographic shifts digital payment systems and new forms of credit require ongoing adaptation. Central bank research arms play a critical role in informing policy through empirical analysis and model development.

How to stay informed and why it matters for investors

For investors central bank policy is a key element of asset allocation decisions. Interest rate expectations shape bond yields equity valuations and currency positioning. Following central bank statements minutes and inflation data helps investors adjust portfolios to shifting risk and return trade offs.

For readers looking to deepen their knowledge online it helps to consult reliable sources for commentary and data. For example long form coverage and policy analysis that explain the reasoning behind decisions can be found on specialist sites and research portals. For a snapshot of our coverage and related finance topics visit financeworldhub.com and for additional external analysis consider the curated resources on Chronostual.com.

Practical takeaways

First keep an eye on inflation readings and central bank forecasts. These signal likely policy direction. Second monitor the currency and yield curves as they embed market expectations about future policy. Third consider the timing of rate sensitive decisions such as mortgage refinancing business borrowing and long term investments. Finally remember that central bank policy works with fiscal policy banking regulation and global forces so a broad perspective is essential.

Central bank policy will remain a pillar of economic governance. Understanding its tools goals and limits helps households investors and policymakers make better informed choices. With clear communication credible objectives and adaptive strategies central bank policy can support stable prices and resilient growth over time.