Forex reserves Explained What They Mean for a Nation and for Investors

Forex reserves are one of the most important indicators of a country financial health and its ability to manage shocks in external markets. In simple terms Forex reserves are assets held by a central bank or monetary authority in foreign currencies. These reserves are used to back liabilities and to influence monetary policy and exchange rates. For readers who want a broad finance perspective we cover the essentials reasons for holding reserves how they are built and how markets react to changes in reserve levels.

What Exactly Are Forex reserves

Forex reserves commonly include foreign currency cash deposits gold special drawing rights at the International Monetary Fund and reserve position in the IMF. Central banks often hold major world currencies such as the United States dollar euro and Japanese yen. These holdings enable authorities to meet external payment obligations and to intervene in currency markets when needed. A clear grasp of what Forex reserves are helps investors and policy watchers interpret official statements and macro data.

Why Nations Hold Forex reserves

There are several core functions for maintaining Forex reserves. First they support import payments and external debt servicing. A nation with ample reserves can pay for essential imports and meet scheduled payments without abrupt adjustments to domestic policy. Second reserves provide a buffer in times of market stress. Sudden capital outflows or commodity price shocks can be absorbed more easily if the central bank has high reserves. Third reserves are used in active exchange rate management. Authorities can buy or sell foreign currency to smooth volatility and guide the value of the domestic currency. Finally reserves contribute to market confidence. High and stable reserves can reduce the likelihood of speculative attacks and help maintain favorable borrowing terms.

How Forex reserves Are Built

Reserves grow when a country runs a surplus in its current account receives foreign direct investment sees net inflows in portfolio investment or benefits from official loans and grants. Central banks may also accumulate reserves through direct intervention when they purchase foreign currency to prevent excessive appreciation of their own currency. Conversely reserves decline when authorities sell foreign currency to support the domestic unit or when capital leaves the country faster than new inflows arrive. Understanding these dynamics allows analysts to separate voluntary accumulation from emergency drawdowns.

Composition and Measurement

Not all reserves are equal. Composition matters because liquidity safety and return differ across assets. Major reserve currencies and highly liquid government bonds are favored for their low credit risk and ease of sale. Gold and special drawing rights provide additional diversification. Analysts monitor reserves in two main ways total value and the coverage ratio. Total value is the aggregate market value often expressed in United States dollars. Coverage ratio is a measure of how many months of imports or how many weeks of external debt service the reserves can cover. A higher coverage ratio implies more resilience to external shocks.

Policy Choices and Trade offs

Maintaining large Forex reserves is not cost free. Reserves typically earn low real returns while the cost of sterilizing inflows or absorbing volatility can be substantial. Policy makers weigh the insurance value of reserves against the fiscal cost of accumulation. Some countries prefer to maintain flexible exchange rates and smaller reserve buffers while others opt for a greater stock of reserves to support managed exchange arrangements. These are strategic choices that reflect exposure to external risk the structure of the economy and the feasibility of alternative policy tools.

What Changes in Forex reserves Signal to Markets

Movements in reserves often convey market signals. A steady rise may indicate successful accumulation through trade surpluses or strong capital inflows. A rapid fall can reflect intervention to defend the currency or pressure from capital flight. Traders and investors watch central bank statements for clarity about the intent behind reserve changes. Sudden falls without explanation can undermine confidence and increase volatility in currency and bond markets. For deeper context and additional finance guides visit financeworldhub.com which publishes regular analysis on macro trends.

Implications for Investors

Forex reserves matter for a variety of investor decisions. Sovereign ratings and bond yields often react to reserve trends. Credit analysts factor reserves into assessments of external vulnerability and repayment capacity. For currency traders reserve data can influence short term positions particularly in economies with active intervention. Portfolio managers who invest in emerging markets consider reserve adequacy when sizing exposure to local debt and equity. In addition policy decisions tied to reserves can affect inflation expectations and interest rate trajectories which in turn shape global asset allocation.

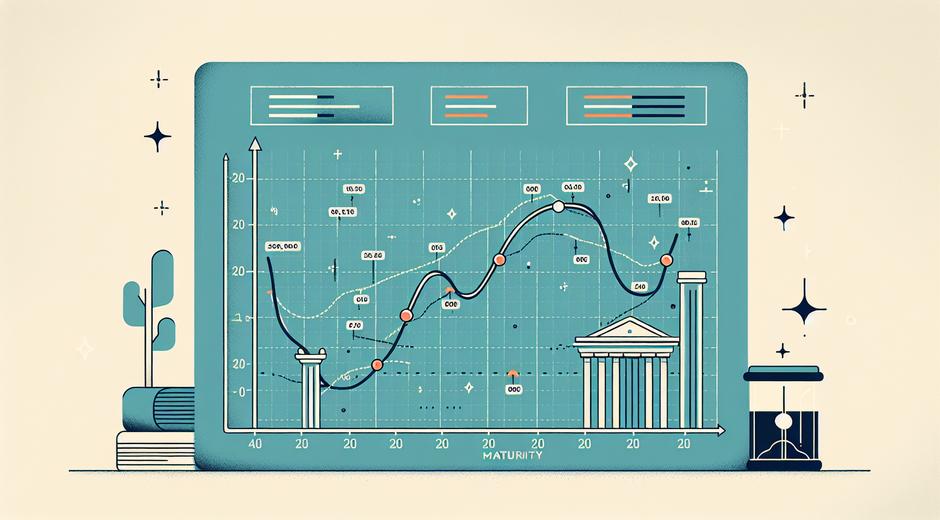

How to Analyze Reserve Data

When you review reserve data look beyond the headline number. Check the composition recent flows and coverage ratios. Compare reserves against short term external liabilities and imports to get a sense of liquidity under stress. Examine the drivers of reserve change for example whether growth is coming from trade surpluses foreign investment or official borrowing. Complement reserve metrics with other indicators such as foreign exchange forward curves balance of payments and external debt schedules. For political economy context and alternative views consult policy commentary at Politicxy.com which explores how politics influences economic choices including reserve management.

Recent Global Trends

Over recent years global reserve totals have shifted due to changes in international trade capital flow regimes and monetary policy cycles. Low global interest rates prompted some central banks to diversify reserve holdings. Commodity exporters saw reserve levels move with commodity price cycles. At times of global stress reserves acted as an important backstop allowing countries to smooth adjustments while coordinating with international institutions. Monitoring global trends can reveal which regions are strengthening their resilience and where vulnerabilities may be rising.

Best Practice for Policy Makers

Central banks that manage reserves effectively follow clear rules and transparent reporting. Best practices include publishing detailed reserve breakdowns regular updates on reserve use and clear communication about intervention objectives. Transparency reduces uncertainty and limits speculation. Policy makers should also balance reserve accumulation with complementary reforms that reduce external vulnerability such as strengthening fiscal frameworks improving export diversification and developing deeper domestic financial markets.

Conclusion

Forex reserves are a core element of macroeconomic management and a key signal for investors and international partners. They provide insurance liquidity and an instrument for influencing the exchange rate. Yet they come with costs and require careful policy trade offs. For anyone tracking global finance or making investment decisions understanding the size composition and trends in Forex reserves is essential. Keep an eye on reserve coverage ratios and the underlying drivers of change and use that insight to form a more informed view of a country external resilience and policy posture.