Understanding the Financial Conditions Index and Why It Matters

The Financial Conditions Index is a powerful composite indicator that summarizes the ease or stress in financial markets. For investors policy makers and business leaders the index acts as an early warning gauge of tightening or loosening financial conditions that can influence growth inflation asset prices and credit availability. In this article we explain how the Financial Conditions Index is constructed what it tracks how to interpret changes and how market participants can use it to make smarter decisions.

What Is a Financial Conditions Index

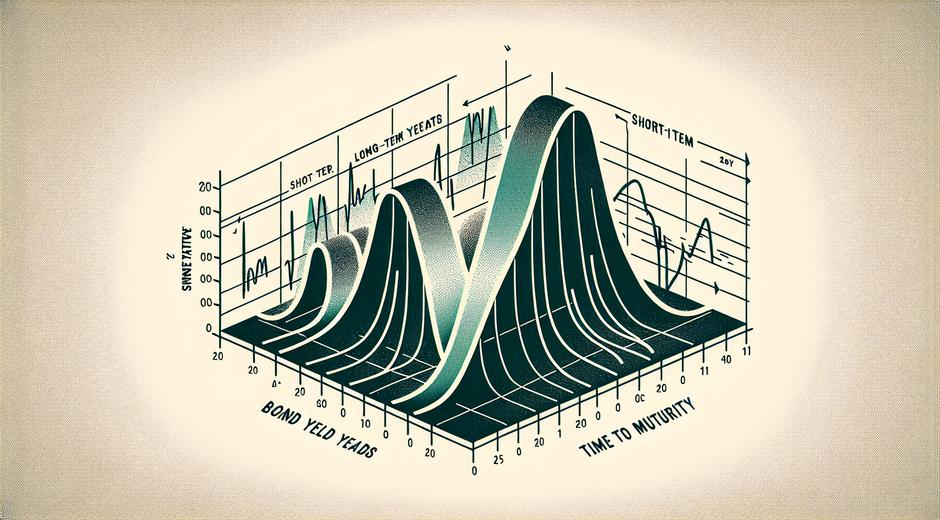

A Financial Conditions Index aggregates multiple market variables into a single number that reflects the overall degree of financial ease or strain. Typical components include short term interest rates long term yields credit spreads equity market performance volatility measures and sometimes measures of liquidity and exchange rates. By combining these inputs the index reduces complex market information into a digestible signal that can be tracked over time.

Unlike a single indicator the Financial Conditions Index captures the interplay between rates credit and asset valuations. For example falling yields and rising equity prices both point to easier financial conditions even if one metric alone gives unclear guidance. The composite nature makes the index useful for monitoring financial market cycles and for assessing the likely path of economic activity.

Core Components and How They Are Weighted

There is no single universal recipe for building a Financial Conditions Index. Different organizations choose variables and weights based on the focus of their analysis. Central banks may emphasize interest rates and credit spreads while private research firms may incorporate equity indices and measures of market liquidity. Common components include:

Short term policy sensitive rates such as the central bank target rate or interbank lending rates

Long term sovereign yields which reflect inflation expectations and term premium

Credit spreads that measure the premium on corporate debt over risk free rates

Equity market levels which reflect market confidence and risk appetite

Volatility indices which signal market stress and uncertainty

Weights are assigned using statistical techniques such as principal component analysis or regression analysis to ensure the index captures the dominant shared movement across variables. The result is a single time series that can be standardized so that positive readings indicate easier conditions and negative readings indicate tighter conditions or vice versa depending on the construction.

Why the Financial Conditions Index Is Useful

The Financial Conditions Index provides several practical benefits for decision makers. First it offers a compact snapshot of market sentiment and policy transmission. When the index tightens sharply it signals that monetary policy or market stress is likely to weigh on investment and consumption. Second it can serve as a leading indicator of macroeconomic turning points. Historically easing financial conditions have preceded economic expansions while tightening often presages slower growth.

Third the index helps risk managers assess portfolio vulnerability. Rapid deterioration in financial conditions often coincides with widening credit spreads falling equity prices and liquidity squeezes. Monitoring the index allows portfolio managers to adjust allocations or hedge exposures before losses accumulate. For corporate treasurers the index can guide timing for debt issuance or refinancing by indicating windows of cheaper funding.

How to Interpret Changes in the Index

Interpreting the Financial Conditions Index requires context. A move toward easier conditions could reflect central bank easing stronger risk taking or improved liquidity. Conversely a move toward tighter conditions might reflect policy tightening rising default risk or an external shock. Analysts typically examine the drivers behind the move by decomposing the index into its underlying components.

Small fluctuations around the mean often reflect routine market noise. Large sustained shifts are more informative about trend changes. For example if equity gains drive easier conditions while credit spreads remain wide the signal for real economic recovery is weaker than when credit spreads also narrow. Corroborating evidence from credit flow data lending surveys and real economy indicators strengthens the interpretation.

Use Cases for Investors and Policy Makers

Investors use the Financial Conditions Index as a tactical and strategic input. Tactical traders may reduce risk exposure when the index tightens rapidly and increase exposure when conditions ease. Strategic investors may incorporate the index into asset allocation models to tilt between risk assets and government bonds based on cycle phase.

Policy makers monitor the index as a gauge of how financial markets are responding to policy actions. If policy tightening produces an outsized tightening in the index then the transmission to the real economy may be stronger than intended. Conversely if easing measures fail to materially loosen the index it may signal impaired transmission mechanisms that warrant alternative interventions.

Limitations and Common Pitfalls

While useful the Financial Conditions Index has limitations. The choice of variables and weights can bias the index toward certain market segments. An index dominated by equity movements may overstate ease when credit conditions remain strained. Structural shifts in markets such as regulatory changes can alter relationships between components making historical comparisons harder.

Another pitfall is over reliance on a single number without qualitative assessment. Market dynamics such as counterparty concentration liquidity risk and off balance sheet exposures are difficult to capture in a simple composite. Practitioners should use the index alongside other indicators and direct market intelligence.

How to Build a Simple Financial Conditions Index

Building a simple Financial Conditions Index for analysis is straightforward. Select a narrow set of representative variables such as a short term rate an aggregate bond yield an equity index and a credit spread. Standardize each series by subtracting the historical mean and dividing by the standard deviation so that units are comparable. Assign weights either equally or using a statistical method and sum the series. Finally rescale the index so that movements are intuitive for your audience.

Back testing the index against historical recessions and expansions helps validate its predictive power. Refinements can include adding liquidity proxies or adjusting weights to better capture the drivers most relevant to your policy or investment objective.

Cross Sector Impacts and Real World Examples

Changes in the Financial Conditions Index ripple through the economy. Tighter conditions increase borrowing costs reduce investment in capital projects and can slow hiring. For consumer facing industries this can reduce discretionary spending. For example industries that rely on digital consumption and entertainment may see demand shifts as households reassess budgets. Coverage of sector specific trends provides useful color on how macro level financial shifts translate into company earnings and consumer preferences. For insight into consumer and entertainment sector developments visit GamingNewsHead.com which reports on trends that can be sensitive to broader financial cycles.

Where to Track Reliable Financial Conditions Indices

Several central banks research institutions and private firms publish Financial Conditions Indices with regular updates. These indices are often accompanied by analysis that explains drivers and policy implications. For ongoing coverage of financial indicators and in depth articles on macro trends visit financeworldhub.com where we provide curated analysis to help you interpret shifts in the Financial Conditions Index and other indicators.

Conclusion

The Financial Conditions Index is an essential tool for anyone who needs a concise read on market stress and the likely direction of economic activity. Its composite nature condenses complex market information into a usable signal that informs investment decisions policy choices and corporate planning. While no index is perfect the disciplined use of a well constructed Financial Conditions Index combined with qualitative market intelligence provides a powerful framework for navigating uncertain times.

Regularly monitoring the index and understanding the underlying drivers will make you better prepared to act as financial conditions evolve.