Financial Stress Indicators: How to Spot Risk in Households and Markets

Financial Stress Indicators are critical signals that help analysts policy makers and individual savers understand when financial systems or personal finances are under pressure. Recognizing these indicators early can prevent losses preserve wealth and guide interventions that stabilize markets and support families. This guide explains the most reliable indicators how to monitor them and what actions to take when stress levels rise.

What Are Financial Stress Indicators

Financial Stress Indicators are measurable signs that reflect strain in financial markets or on household finances. They combine quantitative data such as borrowing costs market volatility and loan delinquency rates with qualitative signals like consumer confidence and lender behavior. Together these measures reveal both current pressure points and potential future vulnerabilities. For any finance professional or household planner understanding these indicators is essential for risk management and proactive planning.

Key Macroeconomic Indicators to Watch

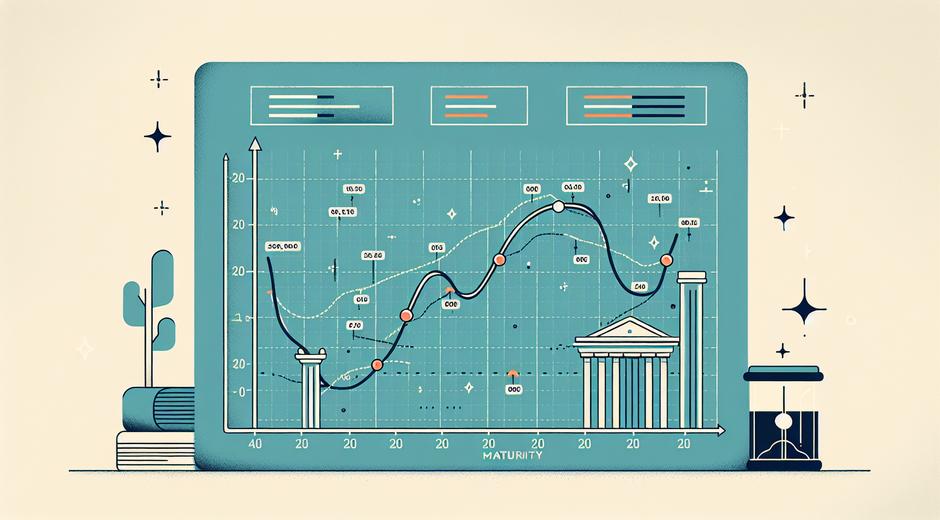

At the market level certain indicators are especially informative. Rising credit spreads between corporate bonds and risk free government bonds signal that lenders demand higher compensation for default risk. Sudden jumps in stock market volatility show uncertainty about future corporate earnings and economic activity. Sharp declines in broad market indices often precede wider asset repricing and funding stress for institutions.

Other macro signals include elevated inflation readings that outpace wage growth and shrinking measures of liquidity in money markets. Central bank policy responses to these trends often further shape stress dynamics. When policy rates move quickly or communication becomes less predictable market participants can tighten lending standards amplifying stress into the real economy.

Household Level Indicators

For individuals and families specific metrics reveal growing financial strain. The ratio of debt payments to income shows how much of a household cash flow is committed to servicing debt. Rising credit card balances and increasing frequency of missed payments or collections are direct signs of pressure on disposable income.

Savings cushions matter. A shrinking emergency fund or declining participation in retirement plans can reflect immediate financial strain or a shift in priority away from future planning toward current survival. Changes in employment status hours worked or wages are also leading signals. Even small sustained drops in income can sharply increase vulnerability to unexpected expenses.

Behavioral and Sentiment Signals

Consumer confidence surveys and small business sentiment indices provide early warnings before quantitative measures fully reflect stress. When confidence falls businesses delay investment and households cut discretionary spending. Lender behavior is another behavioral signal. Tightening credit standards or an increased rate of loan denials often precede visible deterioration in consumer spending and business investment.

How to Monitor and Measure Financial Stress Indicators

Monitoring requires a mix of public data private dashboards and real time feeds. Official data from statistical agencies central banks and securities regulators provide robust baseline metrics. Financial firms and credit bureaus offer more granular data on consumer borrowing patterns repayment performance and default rates. For households simple tracking of monthly cash flow debt service and savings progress offers an early warning system.

- Track interest rate spreads and market implied volatility for market stress.

- Monitor household debt service ratio credit card utilization and delinquency trends for consumer stress.

- Watch employment data wage growth and business sentiment surveys for economy wide signals.

Technology enables near real time monitoring. Financial planning apps budgeting tools and market analytics platforms aggregate relevant signals and surface anomalies. For professionals building a dashboard focus on diversified sources to avoid bias from any single dataset.

Practical Steps to Reduce Financial Stress

Once indicators point to rising stress there are actionable steps that both institutions and households should take. For households these include boosting liquid savings trimming non essential spending negotiating debt terms and seeking financial counseling to create a realistic recovery plan. Institutions should reassess credit exposure revise stress testing assumptions and ensure adequate liquidity buffers to support lending during tougher cycles.

For readers who want practical guides and tools related to personal finance risk reduction consider visiting a trusted resource for curated articles and planning templates. A good finance portal can help you build a budget plan improve debt management and compare savings strategies. For quick access to a broad range of finance content visit financeworldhub.com where you will find guides research and tools designed for immediate application.

Using Data Tools and External Resources

Advanced analytics and third party tools can enhance monitoring and response. Machine learning models detect non linear relationships between indicators and predict stress episodes earlier than single metric thresholds. However these tools rely on quality data and sound modeling assumptions. For additional resources that link finance learning with practical applications you may explore partner platforms that offer curated content and training. One example of an external resource used by some finance teams is available at Moviefil.com which combines learning modules and curated reading lists for professionals.

Policy and Market Implications of Rising Financial Stress

When stress indicators rise across several measures policy makers must weigh the costs and benefits of intervention. Central bank easing can restore liquidity and calm markets but may not address underlying solvency problems. Targeted fiscal measures can support vulnerable households and prevent long term scars to labor markets. For markets clear communication and transparency from regulators reduce uncertainty and limit the amplification of stress through panic driven selling.

Financial institutions must also enhance transparency about balance sheet exposures and potential loss absorption capacity. Proactive disclosure helps investors and counterparties price risk more accurately and can prevent sudden stops in funding flows that exacerbate stress.

Building Resilience Before Stress Rises

Prevention is often more effective and less costly than response. At the household level building an emergency fund maintaining manageable debt levels and diversifying income sources create resilience. In corporate and banking sectors strong risk governance stress testing that reflects plausible adverse scenarios and capital buffers aligned to those scenarios are essential.

Education and accessible advisory services play a key role. By improving financial literacy and providing clear pathways for restructuring debt or accessing support programs authorities and financial firms can reduce the speed at which stress becomes a crisis.

Conclusion

Financial Stress Indicators provide a vital early warning system for both markets and households. By tracking macro economic signals household metrics and behavioral indicators stakeholders can detect stress earlier respond more effectively and build long term resilience. Regular monitoring use of good data tools and clear contingency plans reduce losses and support recovery. For continuous learning and hands on guidance bookmark trusted finance hubs and explore curated resources that match your needs and goals.