Global Financial Stability: Foundations, Risks and Policy Responses

Global Financial Stability is a core objective for policymakers investors and households around the world. Stable global finance supports steady growth enables trade and fosters confidence in savings and investments. When stability falters the consequences can include sharp falls in output sudden spikes in unemployment and lasting scarring of productive capacity. This article explains what drives Global Financial Stability the main threats that can erode it and the tools available to bolster resilience. It also points readers to trusted resources for deeper analysis including financeworldhub.com and to a partner site with related content on sustainable practices at BioNatureVista.com.

Why Global Financial Stability Matters

Financial stability at a global level matters because economies are highly interconnected. Capital flows cross borders rapidly banks and other institutions operate across many jurisdictions and commodity price swings affect producers and consumers worldwide. Stable global finance lowers the cost of borrowing for firms supports steady investment and helps households plan for retirement and large purchases. It also reduces the need for costly emergency responses that often involve public funds and can create long term burdens on taxpayers.

When Global Financial Stability breaks down the impacts can be swift and severe. Liquidity can dry up asset prices can collapse and trust between financial counterparties can vanish. These dynamics amplify through trade channels investment decisions and employment outcomes. Maintaining stability therefore is a public good that requires coordination across national authorities market participants and international bodies.

Key Drivers of Global Financial Stability

Understanding what sustains Global Financial Stability makes it possible to design better policy and risk management. Key drivers include the soundness of banking systems the depth and liquidity of capital markets the quality of sovereign finances and the transparency of financial information. Robust payment and settlement infrastructure reduces operational risk while prudent macroeconomic policy anchors expectations for inflation and growth.

Another important driver is the management of cross border exposures. Large positions in foreign currency or concentrated credit to particular sectors can create vulnerabilities that transmit shocks across borders. Financial innovation and new technologies alter the landscape as well because they can both improve efficiency and introduce new forms of risk that require careful oversight.

Major Risks to Global Financial Stability

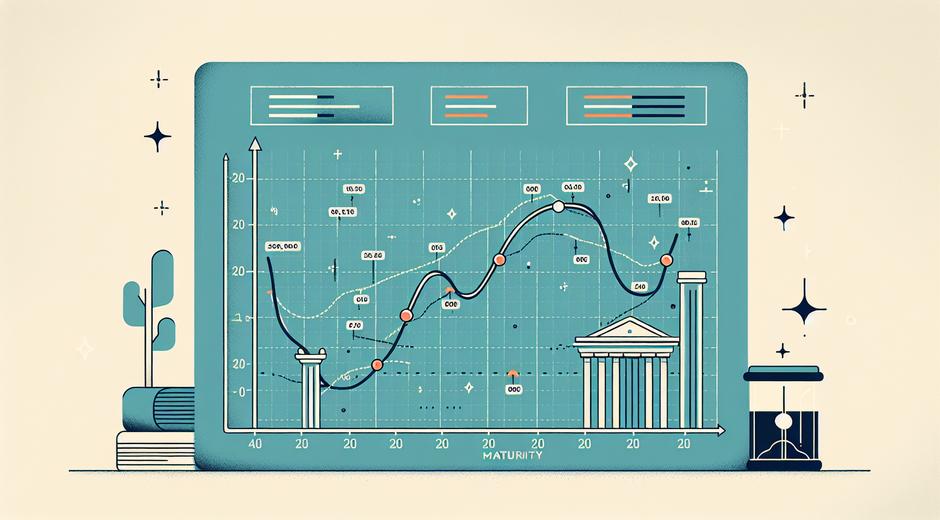

There are several prominent risks that can undermine Global Financial Stability. One is a sharp rise in global interest rates that increases debt service burdens for highly leveraged borrowers and can trigger disorderly adjustments in asset prices. A second risk is a significant correction in real estate markets in one or more large economies which can weaken bank balance sheets and reduce household wealth.

Another risk emerges from the buildup of sovereign debt in low income and middle income countries. If market access tightens or creditor confidence falls governments may need to implement austerity measures that slow growth and increase social strains. Fragmentation in global trade and finance can also raise costs and reduce the scope for risk sharing across economies.

Cybersecurity threats operational failures and climate related shocks are increasingly recognized as sources of systemic risk. For example extreme weather events can damage critical infrastructure and disrupt supply chains with knock on effects for financial claims and market functioning. Similarly vulnerabilities in market data systems or payment rails can produce sudden losses in confidence that impair normal activity.

Policy Tools to Enhance Global Financial Stability

Policymakers have a toolkit to manage these risks and protect Global Financial Stability. Prudential regulation that requires banks and nonbank institutions to hold adequate capital and liquidity is fundamental. Stress testing across multiple scenarios helps authorities and firms assess resilience to adverse developments and to prepare contingency plans.

Macroprudential measures target systemic vulnerabilities such as excessive credit growth or asset price bubbles. These measures can include countercyclical buffers limits on certain types of lending and adjustments to capital requirements that reflect systemic importance. Transparent and credible monetary and fiscal policy also supports stability by shaping expectations and providing a predictable environment for economic decisions.

International cooperation is especially important because shocks often cross borders. Multilateral institutions provide surveillance early warning tools and financing arrangements that help manage crises and reduce the chance of contagion. Coordination of regulatory standards improves the ability of countries to handle cross border bank failures and to protect consumers and investors in global markets.

Role of Institutions and Markets

Financial institutions play a dual role in promoting Global Financial Stability. On one hand they intermediate savings and allocate capital which supports growth. On the other hand they can amplify shocks if they are highly leveraged poorly diversified or subject to runs. Strong governance risk management and clear disclosure requirements help align incentives and reduce the probability of systemic events.

Markets contribute to stability when they are deep transparent and liquid because price discovery and risk distribution function well. Efficient markets absorb shocks by redistributing risks to those best able to bear them. Market failures arise when information is asymmetric when participation is concentrated or when infrastructure is weak. Addressing these weaknesses strengthens resilience.

How Businesses and Individuals Can Prepare

Businesses can support Global Financial Stability by maintaining prudent balance sheets diversifying funding sources and managing currency and interest rate exposures. Scenario planning and stress testing at the firm level improve preparedness for adverse developments. Clear communication with stakeholders and strong governance practices also enhance confidence.

Individuals can contribute by managing household debt levels saving for contingencies and ensuring financial literacy. Diversified portfolios that match time horizons and risk tolerance reduce vulnerability to market swings. Access to trusted information and reputable advisors supports better decision making across personal finance choices.

The Link Between Sustainable Practices and Financial Stability

Sustainability is becoming central to the Global Financial Stability agenda because environmental social and governance factors affect long term risk and return. Climate related risks can produce sudden losses in asset values and affect entire sectors which in turn can stress financial institutions. Incorporating sustainability into investment analysis risk management and policy design helps align incentives and reduce the likelihood of abrupt market corrections.

Innovations in green finance and disclosure standards enable investors to price risks more accurately and to support projects that build resilience. Firms that adopt sustainable practices often strengthen their operational resilience and reputational standing which benefits broader market stability. For readers interested in sustainable approaches and practical solutions see the partner resource at BioNatureVista.com for ideas that complement traditional financial strategies.

Measuring Progress Toward Global Financial Stability

Measuring Global Financial Stability requires a set of indicators that capture both vulnerabilities and market functioning. Common metrics include leverage ratios asset valuation spreads measures of market liquidity and indicators of cross border flows. Early warning systems combine these metrics with qualitative assessments to identify emerging risks before they become severe.

Regular publication of data and stress test results increases transparency and allows market participants to take informed actions. Peer review and international surveillance foster shared understanding of risks and best practice solutions. For those seeking timely commentary on trends and policy developments a reliable source of analysis can be found at financeworldhub.com.

Conclusion

Maintaining Global Financial Stability is an ongoing collective effort involving policymakers regulators institutions and market participants. The landscape continues to evolve as new technologies climate considerations and geopolitical shifts create both opportunities and challenges. By strengthening prudential frameworks enhancing market infrastructure improving transparency and fostering international cooperation economies can reduce the frequency and severity of crises.

For professionals and citizens alike understanding the drivers of Global Financial Stability and applying practical resilience measures can reduce exposure to systemic shocks. Continued dialogue research and adaptive policy will be essential to secure a stable financial future that supports sustainable growth and shared prosperity.