Yield curve What it is and Why it matters to investors

The phrase Yield curve appears frequently in financial news and commentary yet many readers do not fully grasp its meaning or its influence on markets and portfolios. This article provides a clear guide to the Yield curve how it is built what its shapes signal about the economy and how investors can use it to make smarter choices. Understanding the Yield curve helps both individual investors and finance professionals anticipate changes in interest rates growth and risk appetite.

Understanding the Yield curve in plain language

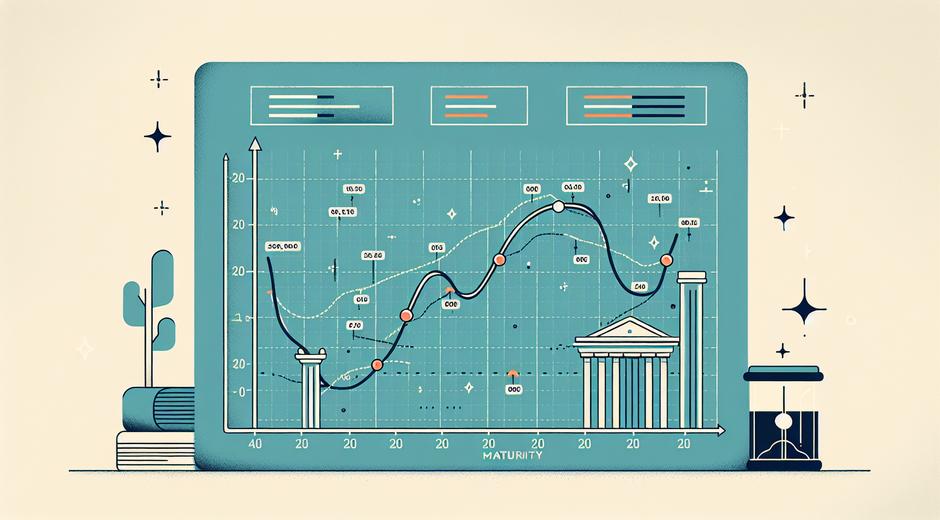

The Yield curve is a graphical representation that shows the relationship between the interest rates of bonds and their time to maturity. Most commonly it refers to government bonds because those rates are viewed as low risk and set a baseline for other asset classes. When you plot yields on the vertical axis and maturity on the horizontal axis you get a line that can take different shapes. Analysts study those shapes to read market expectations about future interest rates inflation and economic growth.

How the Yield curve is constructed

To construct a Yield curve you collect yields for bonds that share the same credit quality but differ in maturity. For example you might plot yields for one month three months one year five year ten year and thirty year government securities. The plotted points are connected to form the curve. Because markets trade continuously the curve moves every day in response to new data central bank guidance and shifts in investor demand.

Common shapes of the Yield curve and what they mean

There are three classic shapes observed in the Yield curve each with distinct implications. A normal shape slopes upward showing higher yields for longer maturities. This structure reflects expectations for economic expansion and higher future interest rates. A flat curve indicates similar yields across maturities and often signals uncertainty about future economic momentum. An inverted curve slopes downward showing higher yields for short maturities than for long ones. Historically an inverted Yield curve has been followed by periods of economic slowdown because investors expect central banks to cut rates in the future as growth weakens.

Why the Yield curve matters to the wider economy

Policymakers corporations and consumers all pay attention to the Yield curve. Banks rely on the spread between short term and long term rates for profit from borrowing short and lending long. When that spread narrows bank lending often becomes less profitable and credit growth may slow. Corporations use the Yield curve to make decisions about issuing debt and planning capital projects. Consumers watching mortgage rates and other financing costs are indirectly affected because those rates track movements across the Yield curve.

Yield curve signals for investors

Investors use the Yield curve as a tool for tactical allocation and risk management. A steepening Curve suggests rising growth and inflation expectations and can favor cyclical equities and commodities. A flattening or inverted Curve suggests slowing growth and can favor defensive equities cash or high quality bonds. Traders also monitor the Yield curve for arbitrage opportunities in fixed income and for signals that guide duration positioning in bond portfolios.

How central bank policy interacts with the Yield curve

Central banks influence the front end of the Yield curve through policy rates and guidance about future policy. When central banks raise their policy rate short term yields tend to rise and the entire curve can shift. Market expectations of future policy changes affect longer term yields. If investors expect future rate cuts longer term yields may fall causing the Yield curve to flatten or invert. Interpreting central bank communications in the context of the Yield curve provides valuable insight into how policy makers and markets view the balance between growth and inflation.

Limitations of the Yield curve as a forecast tool

While the Yield curve provides powerful signals it is not a perfect predictor. The curve reflects market consensus which can change rapidly due to geopolitical events sudden risk repricing or structural shifts in demand for safe assets. Technical factors such as large scale bond purchases from public institutions or changes in supply can alter the shape of the Yield curve without an immediate change in economic fundamentals. Use the Yield curve in combination with other economic indicators and not as a sole basis for major decisions.

Practical ways to incorporate Yield curve analysis into portfolio strategy

There are several practical steps investors can take to incorporate Yield curve analysis into a disciplined investment process. First review the current shape and recent movements of the curve on a regular basis and note any trend from steepening to flattening or vice versa. Second align duration exposure in bond portfolios with your view of where yields are headed. If you expect rates to fall longer duration typically benefits. If you expect rates to rise keeping duration lower reduces sensitivity to rate moves. Third consider credit selection as spreads versus government yields often widen in slower growth environments. Finally use the Yield curve as part of a broader risk management framework to adjust equity sector exposure and cash allocations in response to changing signals.

Yield curve case studies and historical perspective

Historical episodes show how the Yield curve has anticipated major economic turning points. For example prior to several past slowdowns the Yield curve inverted months ahead of the downturn. However there are also times when the curve inverted without a near term recession and markets later normalized. An important lesson is that timing is uncertain and the Curve should inform risk posture not dictate precise tactical timing. Examining historical episodes can sharpen your intuition about how the curve evolves during expansions and contractions.

Where to find reliable data and further reading

Quality data on government yields across maturities is available from official treasury sites and market data providers. For curated articles and guides that explain bond market mechanics in accessible language visit financeworldhub.com where readers can find additional coverage of Yield curve dynamics and related topics. For a complementary perspective on macroeconomic trends and market commentary consider resources like StyleRadarPoint.com which offers analysis that may illuminate how broader cultural and consumer patterns influence financial markets.

Conclusion

The Yield curve is a central concept in finance offering insight into market expectations for interest rates inflation and growth. By learning to read its shape and shifts investors can improve portfolio positioning and risk management. Remember that the Yield curve is one tool among many and works best when combined with other indicators and a clear investment process. Regular monitoring thoughtful interpretation and disciplined response to signals from the Yield curve can make a meaningful difference to long term investment outcomes.