Why NVIDIA Stock Could Be a Game-Changer for Investors in 2025

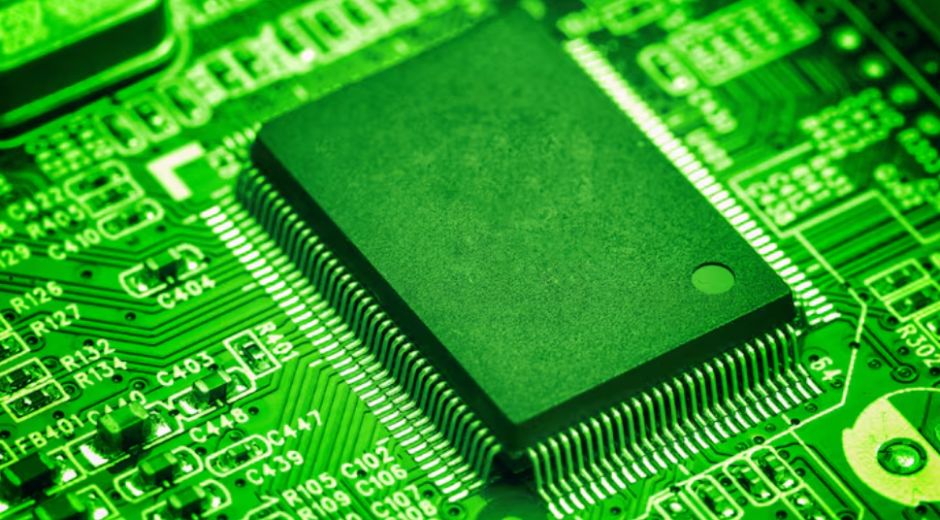

The investment world is constantly searching for the next major growth opportunity, and in 2025, NVIDIA stock is emerging as a strong contender. Known primarily for its graphics processing units (GPUs), NVIDIA has transformed into a technology powerhouse driving innovation in artificial intelligence (AI), data centers, gaming, and more.

This article explores why investors are paying close attention to NVIDIA stock, what is fueling its growth, and the key factors that could make it a game-changer in the stock market this year.

1. Leadership in AI and Machine Learning

NVIDIA has positioned itself at the forefront of AI innovation. Its GPUs are the standard for training complex machine learning models, which power everything from natural language processing to autonomous vehicles.

The company’s AI ecosystem includes CUDA programming platforms, AI frameworks, and hardware optimized for deep learning. This dominance ensures that NVIDIA is not just participating in AI growth but actively shaping the future of the industry.

For investors, this positions NVIDIA stock as a strategic play in the rapidly expanding AI sector, which is projected to grow exponentially over the next decade.

2. Expanding Data Center Market

Data centers have become a critical component of the digital economy, and NVIDIA is benefiting from this surge. Its GPUs accelerate workloads in cloud computing, scientific research, and high-performance computing, making them indispensable for modern infrastructure.

Recent partnerships with major cloud providers and enterprise clients have reinforced NVIDIA’s role in the global data center market. Analysts suggest that ongoing demand for AI and cloud services will continue to drive revenue growth, bolstering the appeal of NVIDIA stock.

3. Gaming Sector Momentum

NVIDIA’s roots in the gaming industry remain a key revenue stream. Its GeForce GPU lineup continues to deliver performance upgrades for high-end gaming and VR applications.

The expansion of e-sports, cloud gaming, and game streaming services ensures a steady demand for GPUs. Investors see this as a stable foundation underpinning NVIDIA stock while new growth sectors mature.

4. Automotive and Autonomous Driving

Another transformative factor for NVIDIA stock is its growing presence in the automotive sector. The company’s DRIVE platform powers advanced driver assistance systems (ADAS) and autonomous driving technologies.

With partnerships spanning major car manufacturers and startups alike, NVIDIA is positioning itself to benefit from the shift toward electric and self-driving vehicles. This diversification enhances its long-term growth prospects.

5. Strategic Partnerships and Acquisitions

NVIDIA’s ability to expand its ecosystem through strategic acquisitions and partnerships is another reason investors are optimistic. By acquiring companies with complementary technologies and forming alliances with leading software and hardware providers, NVIDIA strengthens its competitive edge.

Such moves not only accelerate innovation but also expand revenue streams, making NVIDIA stock attractive for growth-focused investors.

6. Financial Performance and Market Confidence

NVIDIA has consistently demonstrated strong financial performance, with rising revenues, robust margins, and healthy cash flow. Analysts frequently cite its ability to convert technological leadership into profitability as a key differentiator.

As investor confidence grows, NVIDIA stock continues to draw attention from both institutional and retail investors looking for sustainable growth in tech-heavy portfolios.

7. Risks and Considerations

While the outlook is promising, investors should be aware of potential risks. These include:

Market Volatility: Tech stocks can experience rapid price swings.

Competition: Other chipmakers and AI hardware providers could challenge NVIDIA’s dominance.

Regulatory Pressure: Export restrictions, trade tensions, and tech regulation could affect revenue streams.

Balancing these risks with potential growth is crucial when evaluating NVIDIA stock for long-term investment.

8. Long-Term Outlook

Looking toward 2025 and beyond, NVIDIA’s strategic positioning in AI, gaming, data centers, and automotive technologies creates multiple growth avenues. Investors see the company not merely as a chipmaker but as a foundational technology provider shaping future industries.

The combination of innovation, market leadership, and strategic execution makes NVIDIA stock a potential game-changer in modern investment portfolios.

Conclusion: A Stock to Watch

In 2025, NVIDIA stock stands out as a compelling opportunity for investors seeking exposure to high-growth sectors like AI, autonomous vehicles, and cloud computing. While no investment is without risk, the company’s robust technology ecosystem, diverse revenue streams, and forward-thinking strategy make it a stock worth considering for both short-term momentum and long-term growth.

Investors who monitor technological trends, industry developments, and NVIDIA’s evolving market strategies may find that this stock could redefine growth opportunities in the tech sector for years to come.

Education Made Simple

Recession Signals Investors Should Never Ignore

Recession Signals Investors Should Never Ignore

What Stock Rotation Tells Us About the Next Bull Run

What Stock Rotation Tells Us About the Next Bull Run

How Market Cycles Shape Smart Investment Decisions

How Market Cycles Shape Smart Investment Decisions

Long Term Market Forces Driving Global Finance

Long Term Market Forces Driving Global Finance

Cross Market Dynamics Between Assets And Regions

Cross Market Dynamics Between Assets And Regions