Blue Chip Stocks in 2025: Resilience, Reliability, and Real Growth

In every era of finance, one phrase carries a legacy of trust—Blue Chip Stocks. These are the companies that anchor portfolios, weather crises, and consistently deliver shareholder value. In 2025, as markets swing between optimism and uncertainty, Blue Chips once again prove why they are the backbone of global investing.

With strong fundamentals, proven leadership, and decades of brand credibility, Blue Chip Stocks continue to represent the perfect blend of resilience and opportunity.

What Are Blue Chip Stocks?

Blue Chip Stocks are shares of well-established companies with solid earnings, reliable dividends, and dominant positions within their industries. The term “blue chip” originates from poker, where blue chips hold the highest value.

These corporations—often household names—include companies like Apple, Johnson & Johnson, Microsoft, Coca-Cola, and Nestlé. Their influence extends beyond market capitalization; they shape entire sectors and economies.

In times of market turbulence, investors turn to Blue Chip Stocks for one reason: consistency.

Why Blue Chip Stocks Still Matter in 2025

Despite the explosion of speculative assets, startup IPOs, and high-growth tech ventures, the importance of Blue Chips hasn’t faded. If anything, it has strengthened.

In 2025, global investors are refocusing on financial quality—companies with:

-

Stable revenue streams

-

Sustainable dividends

-

Prudent management

-

Durable competitive advantages

According to Bloomberg, over 65% of institutional portfolios maintain Blue Chip exposure as a hedge against market volatility and inflationary shocks.

The logic is simple: while trends change, core businesses with consistent profitability continue to outperform over time.

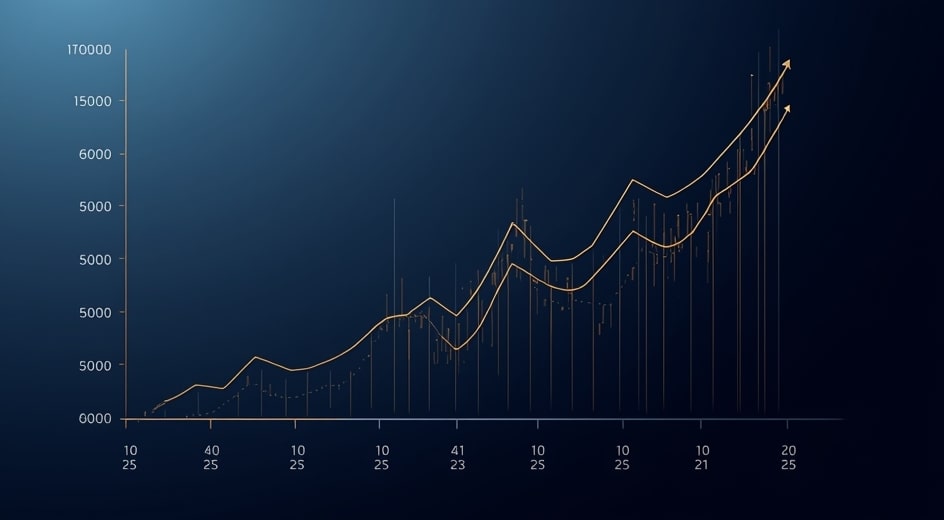

Historical Stability and Performance

Blue Chip Stocks have historically offered lower volatility compared to mid-cap or small-cap equities. During market downturns, their diversified revenue sources and global footprints act as natural stabilizers.

For example, during the market corrections of the early 2020s, major Blue Chips like Procter & Gamble and Microsoft rebounded faster than most tech startups or emerging-market equities. Their established business models, combined with shareholder-friendly policies, proved invaluable to long-term investors.

These companies also tend to provide regular dividends, which compound over time and soften the blow of temporary market losses.

Dividend Power: Income with Stability

One of the strongest appeals of Blue Chip Stocks is their consistent dividend payout. Investors not only benefit from share appreciation but also receive regular income.

Dividend-paying Blue Chips act like reliable engines of wealth accumulation. In 2025, the average dividend yield across top Blue Chip indexes hovers between 2% and 4%, far exceeding most savings accounts or bonds.

Reinvested dividends can dramatically boost total returns over time, turning steady income into exponential compounding. This makes Blue Chips particularly attractive for retirees and long-term investors seeking passive cash flow.

Sector Diversity: Where Blue Chips Lead

Blue Chip companies exist across every major industry, ensuring natural diversification within a portfolio. Key sectors include:

-

Technology: Microsoft, Apple, and Alphabet lead innovation in software, AI, and cloud infrastructure.

-

Healthcare: Johnson & Johnson and Pfizer maintain stable demand through pharmaceutical and medical product leadership.

-

Consumer Goods: Coca-Cola, Unilever, and Nestlé remain staples of global consumption.

-

Financials: JPMorgan Chase and HSBC embody financial resilience and global capital reach.

-

Energy: ExxonMobil and Shell continue adapting toward cleaner energy portfolios.

Holding Blue Chips across multiple sectors helps mitigate risk while capturing growth opportunities from global economic shifts.

The 2025 Market Landscape for Blue Chips

The post-pandemic years reshaped corporate strategies. Companies that successfully embraced digital transformation, automation, and ESG integration are now reaping rewards.

In 2025, Blue Chip Stocks are characterized by three major forces:

-

Resilient cash flows even amid interest-rate volatility.

-

Strong pricing power as brands maintain global demand.

-

Long-term innovation, with many Blue Chips investing heavily in AI and green technology.

This balance between tradition and innovation keeps them relevant in an economy defined by constant evolution.

For updated performance charts and historical comparisons of leading Blue Chip indexes, visit FinanceWorldHub where our analysts track yield, P/E ratios, and market capitalization trends weekly.

Globalization and Blue Chips’ Expanding Influence

Blue Chip Stocks are no longer purely American or European. In 2025, Asian corporations like Samsung, Toyota, and Tata Consultancy Services have joined the elite ranks, reflecting the globalization of corporate dominance.

Emerging-market Blue Chips, often referred to as “rising blue chips,” are companies that demonstrate Western-level governance standards and scalability. They are increasingly included in institutional portfolios seeking international exposure without speculative risk.

This global expansion is reshaping what it means to be a Blue Chip—stability is no longer limited by geography.

The Role of ESG in Blue Chip Investing

Sustainability is now a defining feature of Blue Chip behavior. Investors and consumers alike demand accountability, transparency, and responsible practices.

Leading companies have integrated ESG (Environmental, Social, and Governance) goals into their operations, from carbon reduction to ethical supply chains. These initiatives not only protect reputations but also drive profitability by appealing to eco-conscious consumers and reducing regulatory risks.

ESG-focused Blue Chips are outperforming traditional peers in several markets, proving that responsible capitalism and financial success can coexist.

You can review comparative ESG rankings and dividend performance Moviefil to explore which companies are leading in ethical profitability this year.

Why Institutional Investors Favor Blue Chips

Pension funds, sovereign wealth funds, and insurance companies all rely heavily on Blue Chip Stocks. The reason is structural—they offer liquidity, stability, and predictable returns.

Institutional investors prioritize capital preservation alongside growth, and Blue Chips provide both. With large market capitalizations and consistent dividend yields, they ensure portfolios meet both short-term obligations and long-term growth targets.

Even in 2025’s complex financial environment, these stocks remain the anchor assets in global fund management.

Technology and the New Blue Chips

The definition of “blue chip” evolves with technology. Two decades ago, manufacturing and energy giants ruled the market. Today, digital transformation has crowned a new generation of leaders—Apple, Nvidia, and Amazon—whose scale and innovation rival traditional titans.

Tech Blue Chips now account for a significant share of global market capitalization. Their balance sheets are cash-rich, and their global reach extends across industries from retail to AI.

This evolution shows that being a Blue Chip is no longer about industrial age dominance, but digital adaptability.

How to Identify True Blue Chips

Investors looking to build a Blue Chip portfolio should focus on four key metrics:

-

Earnings consistency over at least ten years.

-

Strong dividend history with minimal cuts during recessions.

-

High credit ratings and manageable debt levels.

-

Global brand recognition with proven pricing power.

A company that meets these criteria typically weathers economic downturns better than peers and maintains investor confidence through every cycle.

Risks and Realities

While Blue Chips are safer than most equities, they’re not immune to risks. Overvaluation, regulatory changes, and technological disruption can affect even the largest companies.

In 2025, some long-established firms face competitive threats from agile startups or shifting consumer behavior. Investors must remain selective, regularly reviewing fundamentals and diversification to avoid concentration risk.

The goal isn’t blind trust—it’s informed confidence.

Blue Chips and the Inflation Hedge

One reason investors love Blue Chips in 2025 is their natural hedge against inflation. Companies with pricing power can pass cost increases to consumers without hurting margins.

Consumer-goods and healthcare Blue Chips, in particular, thrive during inflationary cycles. Their products remain essential, and their scale allows them to manage supply chain pressures effectively.

This ability to maintain profitability even when economic conditions tighten makes Blue Chips a safe harbor in inflationary periods.

Dividends, Compounding, and Wealth Creation

Reinvesting dividends from Blue Chips creates a compounding effect that accelerates wealth accumulation. A steady 3% yield compounded annually can increase portfolio returns significantly over decades.

For example, an investor putting $50,000 into a dividend-paying Blue Chip portfolio with a 7% annual return could see that investment grow to nearly $200,000 in 20 years—without additional contributions.

This power of compounding explains why financial advisors consistently emphasize dividend reinvestment strategies for long-term stability.

The Psychology of Blue Chip Investing

Blue Chips appeal to rational investors. They remove the constant anxiety of speculation and allow long-term focus. While fast-growth stocks can deliver excitement, Blue Chips deliver security—a value often underestimated until volatility strikes.

Owning them provides confidence that even during downturns, the companies behind those shares will continue to generate real value, pay dividends, and recover over time.

This reliability creates peace of mind, turning investing into strategy rather than stress.

The Future of Blue Chips: Innovation Meets Legacy

Looking ahead, Blue Chip companies are far from static. Many are reinventing themselves through AI integration, renewable energy investments, and digital infrastructure expansion.

For instance, automakers like Toyota are transitioning to electric mobility, while industrial leaders like Siemens are digitizing manufacturing ecosystems. This evolution ensures that Blue Chips will not only survive future disruptions but define them.

Investors can expect these companies to blend their traditional strengths—capital discipline and global scale—with modern agility and technological foresight.

Practical Portfolio Strategy for 2025

Building a Blue Chip-focused portfolio in 2025 can be approached in several ways:

-

Core holdings: Choose 10-15 diversified Blue Chips across multiple sectors.

-

Dividend reinvestment: Automatically reinvest dividends to compound returns.

-

Global balance: Include US, European, and Asian leaders to mitigate currency risk.

-

Periodic review: Reassess annually to adapt to market and regulatory changes.

-

Index exposure: Complement with Blue Chip ETFs to achieve broader diversification.

This framework ensures investors benefit from both the strength of individual companies and the resilience of diversified markets.

Conclusion: The Enduring Power of Blue Chip Stocks

Through every market cycle, Blue Chip Stocks have proven one enduring truth—quality lasts. In 2025, they remain the foundation of successful investing, offering the perfect blend of safety, stability, and sustainable growth.

As speculative trends rise and fade, Blue Chips continue to quietly compound wealth, reward patience, and define trust in global finance.

Their story is one of endurance, evolution, and excellence—and for investors focused on long-term prosperity, they are not just a choice but a cornerstone.

Education Made Simple

Recession Signals Investors Should Never Ignore

Recession Signals Investors Should Never Ignore

What Stock Rotation Tells Us About the Next Bull Run

What Stock Rotation Tells Us About the Next Bull Run

How Market Cycles Shape Smart Investment Decisions

How Market Cycles Shape Smart Investment Decisions

Long Term Market Forces Driving Global Finance

Long Term Market Forces Driving Global Finance

Cross Market Dynamics Between Assets And Regions

Cross Market Dynamics Between Assets And Regions

Global Financial Shifts Reshaping Investment Strategies

Global Financial Shifts Reshaping Investment Strategies

Market Confidence Signals In Volatile Periods

Market Confidence Signals In Volatile Periods