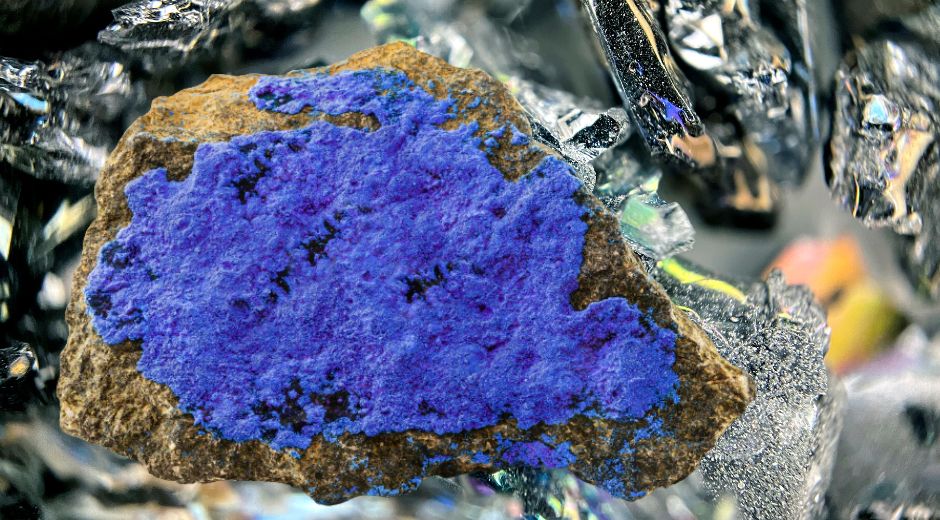

Cobalt Supply Chain: Navigating Risks and Opportunities in Global Commodities

The cobalt supply chain has become a focal point in global commodities markets due to its essential role in battery production, electric vehicles (EVs), and advanced technology applications. As the world accelerates toward a low-carbon future, cobalt — a critical metal in lithium-ion batteries — faces unprecedented demand, creating both opportunities and challenges for investors, manufacturers, and policymakers.

Understanding the Cobalt Supply Chain

The cobalt supply chain involves multiple stages:

Mining and Extraction: The Democratic Republic of Congo (DRC) dominates global cobalt production, supplying over 60% of the market. Other producers include Russia, Australia, and Cuba.

Refining and Processing: Extracted cobalt is refined into high-purity products for use in batteries, electronics, and specialty alloys.

Battery Manufacturing: Refined cobalt is integrated into cathodes for lithium-ion batteries, a critical component for EVs and energy storage systems.

End-Use Applications: Finished batteries power EVs, consumer electronics, and renewable energy storage systems, driving demand along the supply chain.

This interconnected system highlights the importance of efficient, ethical, and secure sourcing practices.

Factors Driving Cobalt Demand

Several global trends are fueling demand across the cobalt supply chain:

Electric Vehicle Revolution: As EV adoption accelerates, automakers require high-performance batteries containing cobalt to ensure energy density and longevity.

Renewable Energy Storage: Grid-scale energy storage systems rely on lithium-ion batteries with cobalt-based cathodes for stability and efficiency.

Consumer Electronics: Smartphones, laptops, and portable devices continue to depend on cobalt-containing batteries.

Technological Innovation: Advancements in battery chemistry and performance often depend on cobalt to enhance safety, capacity, and longevity.

According to Investing.com, the surge in EV production is expected to double cobalt demand over the next decade, placing increased pressure on the supply chain.

Risks and Challenges

Despite its importance, the cobalt supply chain faces significant challenges:

Geopolitical Concentration: Heavy reliance on the DRC exposes the supply chain to political instability, labor disputes, and regulatory changes.

Ethical Concerns: Artisanal mining practices in certain regions raise human rights and child labor issues, prompting scrutiny from regulators and investors.

Price Volatility: Limited supply relative to demand can lead to price spikes, affecting battery manufacturers and end-product costs.

Environmental Impact: Mining and refining cobalt can result in substantial ecological damage if not properly managed.

Mitigating these risks requires robust sourcing strategies, transparency initiatives, and investment in sustainable mining practices.

Strategies for a Resilient Supply Chain

Industry leaders are implementing multiple strategies to strengthen the cobalt supply chain:

Diversification of Sources: Reducing reliance on a single country by sourcing cobalt from multiple regions and developing new mining projects.

Recycling and Circular Economy: Battery recycling programs reclaim cobalt from spent batteries, reducing dependency on primary mining.

Supply Chain Transparency: Blockchain and certification programs track cobalt from mine to end-product, ensuring ethical sourcing.

Strategic Partnerships: Automakers, battery manufacturers, and mining companies collaborate to secure long-term supply agreements.

These measures help stabilize supply, reduce ethical risks, and provide investors with more predictable market dynamics.

Investment Opportunities in Cobalt

Investors seeking exposure to the cobalt supply chain can explore multiple avenues:

Mining Companies: Direct investment in companies like Glencore or China Molybdenum provides upstream exposure.

Battery Manufacturers: Firms incorporating cobalt in battery cathodes offer indirect exposure to metal demand.

Commodities ETFs: Cobalt-focused or battery-metal ETFs allow diversified exposure while mitigating company-specific risks.

Resources like Financeworldhub.com provide detailed analysis of market trends, investment strategies, and supply chain developments in cobalt.

Technological Innovations Impacting Cobalt

Several technological trends are shaping the cobalt supply chain:

Battery Chemistry Optimization: Research into reducing cobalt content in lithium-ion batteries aims to lower costs and mitigate ethical concerns.

Recycling Technologies: Improved extraction techniques for spent batteries increase the recoverable cobalt supply.

AI and Analytics: Predictive analytics help forecast demand, optimize production, and manage inventory across the supply chain.

Blockchain Tracking: Ensures provenance verification, ethical compliance, and transparency from mine to end-product.

Industry insights from StyleRadarPoint.com highlight the importance of combining technological innovation with sustainable sourcing practices to secure long-term market stability.

Future Outlook

The cobalt supply chain is poised for continued growth as global energy transitions accelerate. Key trends include:

Expansion of EV production and renewable energy infrastructure.

Technological improvements in battery efficiency and recyclability.

Strengthened regulatory oversight and ESG compliance.

Increased investment in upstream mining and refining projects.

Long-term projections suggest that cobalt will remain a critical commodity for global technological development, making supply chain optimization and risk mitigation top priorities for stakeholders.

Conclusion

The cobalt supply chain is central to the evolution of modern energy and technology sectors. From EVs to consumer electronics and renewable energy storage, cobalt’s role is indispensable.

Managing supply risks, ensuring ethical sourcing, and embracing technological innovation are key to securing a resilient and sustainable cobalt market.

Investors, manufacturers, and policymakers must stay informed about the dynamics of the cobalt supply chain to navigate opportunities and mitigate risks in this rapidly evolving sector.

Education Made Simple

Recession Signals Investors Should Never Ignore

Recession Signals Investors Should Never Ignore

What Stock Rotation Tells Us About the Next Bull Run

What Stock Rotation Tells Us About the Next Bull Run

How Market Cycles Shape Smart Investment Decisions

How Market Cycles Shape Smart Investment Decisions

Long Term Market Forces Driving Global Finance

Long Term Market Forces Driving Global Finance

Cross Market Dynamics Between Assets And Regions

Cross Market Dynamics Between Assets And Regions

Global Financial Shifts Reshaping Investment Strategies

Global Financial Shifts Reshaping Investment Strategies

Market Confidence Signals In Volatile Periods

Market Confidence Signals In Volatile Periods